Commodities

Trade expertly, we handle your environment

Trade over 100+ FX pairs with tight spreads and rapid order execution on CFDs.

Why Choose Commodities Trading with A and Capital Ltd?

Enjoy unmatched spreads and rapid execution in the largest and most liquid market globally

Industry-Leading Performance

Exceptional Spreads for Better Trading.

Reliable Support

Exceptional Service for Your Peace of Mind.

Diversify Your Portfolio

BetAccess a Wide Range of Assets for Enhanced Trading Opportunities.

Fund's Protection

Trustworthy Measures to Ensure the Security of Your Funds.

Transparent Operations

Clear Insights into Your Investments.

Clarity and Integrity

Providing Clear Visibility into Every Aspect of Your Trading Experience.

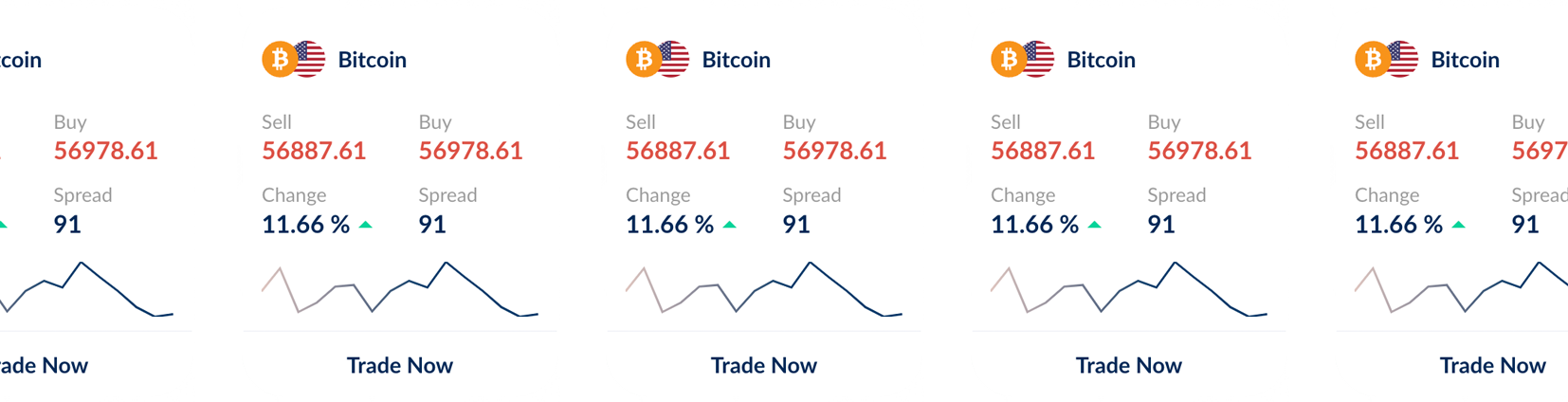

Trade Foreign Exchange Pairs With Transparent Pricing and Rapid Execution

Trade Energy Commodities with Spot Trading?

Engage in spot trading with energy commodities.

At A and Capital Ltd, we offer our clients the opportunity to trade spot energy, including Brent, WTI, and Natural Gas, which are among the most vital raw material resources worldwide. Explore these assets to uncover potential trading prospects in the financial market.

CFDs on energy are favored for short-term trading, particularly during periods of heightened energy consumption when demand surges. Prices are influenced by global supply and demand dynamics for the physical product.

Referred to as "black gold", Oil is predominantly priced in U.S. Dollars, leading to a rise in Oil prices during periods of weak dollar valuation. Oil-producing nations wield significant influence over supply and prices by adjusting production levels.

For instance, sanctions imposed on Iran since the mid-90s restricted Iranian oil supply, resulting in higher prices due to supply-demand imbalances. Conversely, a decrease in demand from the EU and China in 2014 led to a sharp price decline due to surplus supply. Additionally, the release or domestic use of oil reserves by the US government can potentially cause a significant drop in energy prices

In the case of NatGas, an alternative energy commodity to oil, historical analysis reveals a general correlation between the two. This is due to the fact that natural gas is often extracted alongside oil during drilling processes and is commonly produced by the same companies or nations.

In conclusion, various economic factors can influence energy prices, including inflation rates, political tensions in producing nations, natural disasters, production costs, and OPEC decisions.

Trading CFDs on energy enables you to speculate on price movements without physically owning the underlying asset. As prices fluctuate, traders can profit or incur losses based on their market positions and directions. Explore our Educational Section for comprehensive insights and feel free to practice trading on spot energy with our free demo account before transitioning to live trading.

Select an asset above to access real-time charts of spot energy and start trading with A and Capital Ltd today. Benefit from the ability to buy or sell energy CFDs (Contracts for Difference) through our award-winning trading platforms.

Trade spot energy with A and Capital Ltd!

Start trading in 3 Steps

Our aim is to deliver the ultimate trading journey for you. Fueled by our passion for online trading.

Fill in the form

Provide your details quickly and easily to get started on your journey with us.

Fund your account

Choose from our array of multi-payment options to effortlessly add funds to your account.

Place your first trade

Take the exciting step of placing your initial trade, embarking on your journey as a trader with us.