Metals

Trade expertly, we handle your environment

Trade over 100+ FX pairs with tight spreads and rapid order execution on CFDs.

Why Choose Metals Trading with A and Capital Ltd?

Enjoy unmatched spreads and rapid execution in the largest and most liquid market globally

Industry-Leading Performance

Exceptional Spreads for Better Trading.

Reliable Support

Exceptional Service for Your Peace of Mind.

Diversify Your Portfolio

BetAccess a Wide Range of Assets for Enhanced Trading Opportunities.

Fund's Protection

Trustworthy Measures to Ensure the Security of Your Funds.

Transparent Operations

Clear Insights into Your Investments.

Clarity and Integrity

Providing Clear Visibility into Every Aspect of Your Trading Experience.

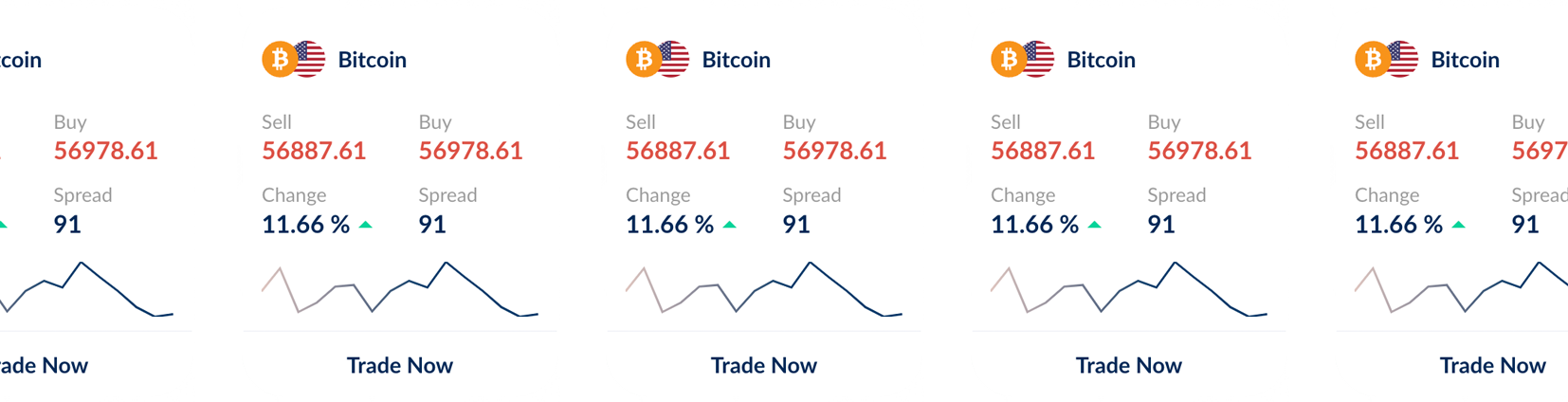

Trade Foreign Exchange Pairs With Transparent Pricing and Rapid Execution

What Exactly is Metals?

Trading CFDs includes Precious Metals like gold and silver. Gold, highly liquid, reacts to economic shifts, especially US interest rates, and correlates with major currencies like the Euro and the Dollar. While sometimes negatively correlated, it can also show positive correlations, such as with the Australian dollar, both moving upward simultaneously.

Factors Affecting Metal Quotes Metal trading is influenced by seasonal variations, market activity levels, and daily trends. Trading decisions are typically based on Economic Calendar data, with a focus on statistics from key economies like the United States and China.

Silver: Global industrial activity, including silver mining and major buyer trends, significantly impact the silver market. Monitoring high-tech and metal-mining news alongside regional developments is crucial for predicting price movements. Factors such as production issues or investment influxes can lead to market fluctuations. Silver prices are influenced by global economic indicators like inflation, GDP growth, and central bank decisions, particularly during economic uncertainty when investors seek refuge in Precious Metals.

Gold and silver generally react negatively to stock index growth, reducing their appeal as 'safe assets'. Analysts predict a continuous upward trend for silver due to its limited supply.

Platinum: Supply-demand balance is the primary determinant of platinum's exchange value. Unlike gold, platinum is only found in alloy form, making its extraction complex and energy-intensive. With a global annual production of approximately 5 million troy ounces, platinum output is significantly lower compared to gold and silver. Despite this, platinum's unique properties sustain demand across various industries, with around 40% of it utilized in automobile manufacturing.

Start trading in 3 Steps

Our aim is to deliver the ultimate trading journey for you. Fueled by our passion for online trading.

Fill in the form

Provide your details quickly and easily to get started on your journey with us.

Fund your account

Choose from our array of multi-payment options to effortlessly add funds to your account.

Place your first trade

Take the exciting step of placing your initial trade, embarking on your journey as a trader with us.